Paris Escort Services Business: In‑Depth Market Analysis

In the heart of the City of Light, a discreet yet lucrative segment of the economy is booming: Paris escort services. While the Eiffel Tower draws millions of tourists, a hidden network of agencies, online platforms, and independent professionals generates hundreds of millions of euros each year. This article breaks down the numbers, the legal backdrop, the business models, and the future outlook, giving readers a clear picture of why this industry thrives.

Market Overview

According to a 2024 industry report, the adult entertainment sector in France contributed roughly €5.3billion to the national GDP, with escort services in Paris accounting for about 12% of that share. That translates to an estimated €630million in annual revenue. The growth rate has averaged 7% per year over the past five years, outpacing the broader tourism sector, which grew at 3%.

Paris escort services are a subset of the French adult entertainment industry that provide companionship and intimate experiences to clients, typically booked through agencies, online platforms, or independent arrangements operate across three primary channels: street‑based independent escorts, agency‑managed professionals, and technology‑driven online platforms. Each channel serves distinct client segments and faces unique regulatory pressures.

Revenue and Scale

The average hourly rate in Paris sits at €250 for agency‑affiliated escorts, €180 for independent online‑booked professionals, and €120 for street‑based providers. High‑end boutiques-offering multilingual companions and luxury experiences-can command €500 per hour or more. Multiplying these rates by an estimated 2.4million client hours logged annually yields the €630million figure cited earlier.

Key revenue drivers include:

- International tourists (45% of clients) seeking discreet companionship during short stays.

- Business travelers (30%) who value premium, English‑speaking escorts for networking events.

- Local high‑net‑worth individuals (25%) who prefer repeat engagements and customized experiences.

Regulatory Landscape

France’s approach to prostitution is unique: buying sexual services is legal, but organized exploitation is criminalized under the French prostitution law (Loi n° 2016‑442) which penalizes third‑party profiteering and mandates health checks for sex workers. The law targets “pimps” and unlicensed agencies, but it does not directly prohibit consensual escort arrangements.

The French Ministry of the Interior oversees enforcement of the prostitution law and coordinates with local police units to monitor illegal brothel activities has adopted a pragmatic stance, focusing resources on trafficking while allowing regulated escort services to operate-provided they maintain transparent contracts and avoid coercion.

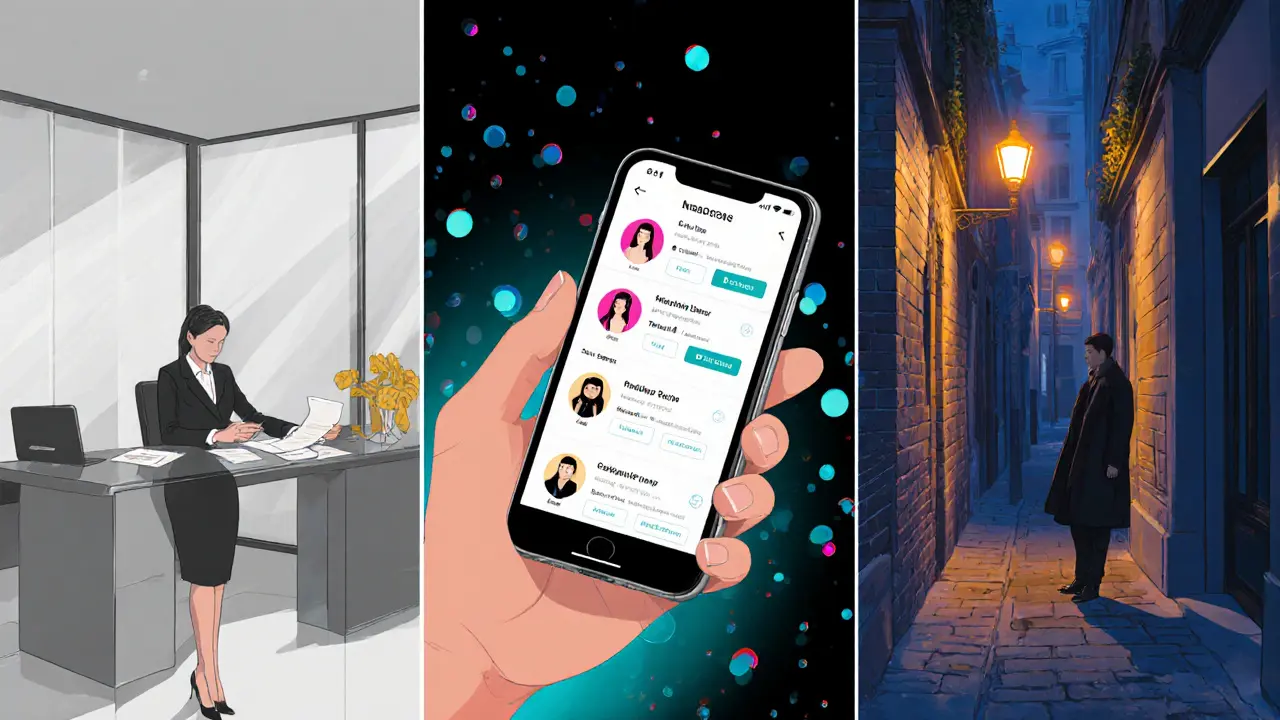

Business Models

Three dominant models define the market:

- Agency‑Based Model: Licensed agencies screen escorts, handle bookings, and take a 30‑40% commission. Agencies invest in marketing, client vetting, and legal compliance.

- Online Platform Model: Websites and apps (e.g., EliteCompanion, ParisElite) charge a flat subscription fee (€150per month) plus a 20% transaction fee. Platforms benefit from scale, offering instant booking and client reviews.

- Independent Street Model: Escorts operate without intermediaries, relying on personal networks and word‑of‑mouth. Earnings are higher per hour, but risk and administrative burden are also higher.

The rise of mobile‑first platforms has shifted the balance toward the online model, which now captures an estimated 55% of the market share.

Pricing Trends

Pricing is influenced by several factors:

- Seasonality: Summer months (June‑August) see a 20% price bump due to higher tourist volume.

- Service Tier: Luxury tiers (multilingual, high‑profile clients) command a premium, often bundled with hospitality services.

- Regulatory Pressure: Periodic crackdowns force agencies to increase rates to cover legal fees and security measures.

Projected average price growth is 4.5% annually, aligning with inflation and rising disposable income among target client groups.

Client Demographics

Understanding who pays for escort services clarifies demand patterns:

| Segment | Age Range | Typical Spend per Visit | Primary Motivation |

|---|---|---|---|

| International Tourists | 25‑45 | €400‑€800 | Companionship & local experience |

| Business Travelers | 30‑55 | €600‑€1,200 | Networking & social events |

| Local High‑Net‑Worth | 35‑65 | €800‑€2,000 | Long‑term companionship |

Data from the 2023 Paris Escort Survey (n=2,100 respondents) indicate that 68% of clients prioritize discretion, 52% value multilingual ability, and 39% seek escorts with cultural knowledge (art, cuisine, fashion).

Future Outlook

Three trends will shape the next five years:

- Digital Integration: AI‑driven matchmaking and virtual reality experiences are being piloted, promising higher engagement and premium pricing.

- Regulatory Tightening: Expected amendments to the 2016 law may introduce mandatory licensing for agencies, increasing compliance costs but also legitimizing reputable operators.

- Tourism Recovery: Post‑pandemic travel rebounds, with projected 2026 tourist arrivals in Paris exceeding 35million, fueling sustained demand.

Stakeholders who invest in technology, maintain rigorous legal compliance, and refine luxury service offerings are likely to capture the bulk of future growth.

Comparison of Service Channels

| Channel | Avg. Hourly Rate (EUR) | Legal Risk | Booking Method | Client Base |

|---|---|---|---|---|

| Street Independent | 120 | High (no contracts) | In‑person, phone | Local, budget‑conscious |

| Agency Managed | 250 | Medium (agency liability) | Online portal, phone | Business travelers, tourists |

| Online Platform | 180 | Low (platform compliance) | App/website instant booking | Tech‑savvy, repeat clients |

Key Takeaways

- The Paris escort market generates around €630million annually, growing at ~7% per year.

- Online platforms now dominate, capturing over half of the market share.

- Regulatory risk is concentrated on third‑party exploitation; compliant agencies thrive.

- High‑end luxury services command premium pricing and attract business travelers.

- Future growth hinges on digital innovation and evolving legal frameworks.

Frequently Asked Questions

How much does an escort in Paris typically cost per hour?

Rates vary by service channel: street‑based escorts average €120/hour, agency‑managed professionals charge around €250/hour, and online‑platform escorts fall near €180/hour. Luxury boutiques can exceed €500/hour.

Is hiring an escort legal in France?

Yes, purchasing consensual sexual services is legal. However, third‑party profiteering, trafficking, and unlicensed brothels are criminal offenses under the French prostitution law.

What are the main differences between agency and online platform escorts?

Agencies handle screening, contracts, and higher commissions (30‑40%). Online platforms offer lower commissions (≈20%) and instant booking via apps, but rely on user reviews for quality control.

How does seasonality affect pricing?

During the summer tourism peak (June‑August), average rates rise by about 20% due to heightened demand. Conversely, winter months can see modest discounts.

What future technologies are being tested in the escort industry?

AI‑driven matchmaking algorithms, virtual reality companionship experiences, and blockchain‑based payment systems are in pilot phases, aiming to enhance privacy and personalization.